The Global Trends in Renewable Energy Investment report published in September by the UN Environmental Programme (UNEP) portrays an astonishing decade of transition for renewable energy technologies. From minor, emergent technologies, solar photovoltaics (PV) and wind in particular have become, in the space of just ten years, for many countries the most cost-effective source of electricity supply, regardless of their environmental benefits, UNEP says.

By end-2019, UNEP expects $2.5 trillion to have been invested worldwide in renewable energy sources, of which nearly $1.3 trillion was in solar power, $1 trillion in wind and $115 billion in biomass and waste-to-energy.

Renewable Energy Capacity Investment over the Decade, 2010 - 2019 ($BN)

Includes an estimate for 2019, based partly on provisional first-half data. (Source: UN Environment, Frankfurt School-UNEP Centre, BloombergNEF)The importance of these investments was underlined by International Energy Agency (IEA) Executive Director Fatih Birol in a statement issued September 20. Birol described offshore wind, onshore wind and solar PV as the “mainstays of the world’s efforts to tackle climate change, reduce air pollution and provide energy access to all.”

China has been the world leader in renewable energy investment over the report period (2010-2019), investing $758 billion, while Europe as a whole invested $698 billion, led by Germany, while $356 billion was invested in the US.

The UNEP report notes a broadening of investment across countries in 2018 with more than 29 countries each investing more than $1 billion.

Renewable Energy Capacity Investment from 2010 to 1H 2019

Top 20 Countries, $BN (in Billion). Includes first-half data for 2019, but not an estimate for the second half. Source: UN Environment, Frankfurt School-UNEP Centre, BloombergNEFCost reductionsRenewable energy technologies have required substantial government support alongside public and industry commitment, based on the belief that the environmental benefits of renewables would outweigh their high initial costs. UNEP’s findings bear out the success of this belief. Over 2010-2019, the Levelized Cost of Electricity for solar photovoltaics has fallen a whopping 81%, onshore wind costs have dropped 46%, while offshore wind costs have plummeted 44%, the report says. These gains have resulted from a number of factors – economies of scale in manufacturing, fierce supply-chain competition boosted by the introduction of competitive auctions for new capacity, technology improvements and record low costs for finance. Wind generates most clean powerInvestment in renewables capacity in 2018 was about three times global investment in coal and gas-fired generation capacity combined, UNEP says. Solar, mainly PV, has seen the most extraordinary expansion from just 25 GW in 2009 to an estimated 638 GW by end-2019. However, when it comes to clean energy actually generated, it is wind that takes the top spot. Data from BP’s Statistical Review of World Energy shows wind generated 1,280 TWh of clean electricity in 2018, more than two times solar’s 575 TWh, with other renewable technologies, excluding large hydro, contributing 626 TWh. |

Global renewable electricity generation 2009-2018 (TWh)

Source: BP Statistical Review of World Energy 2019Bankability

Renewable energy projects require capital. To date they have largely been supported by Feed-in Tariffs or certificate schemes that provide additional revenue to operators in addition to the wholesale cost of electricity.

These supports make the projects ‘bankable’, allowing developers to raise finance from investors such as banks and pensions funds. This brings in capital from outside developers’ own balance sheets to provide the money necessary to meet climate change targets.

More recently, competitive auctions for generating capacity have been introduced, helping to push costs down further, lowering the impact of subsidies on consumers.

The UNEP report estimates that the amount of renewable energy capacity subject to competitive auction rose from 3 GW in 2012 to 52 GW in 2017.

“Pace must increase”

However, far from standing on past achievements, UNEP emphasises that “the pace must increase”. Despite their rapid growth, renewables, including large hydro, accounted for only 25.3% of total electricity generated in 2018.

According to the IEA, renewable capacity additions need to grow by more than 300 GW a year on average from 2018 to 2030 to reach the goals of the Paris Agreement on Climate Change.

Supportive policies critical

While the 12% drop in renewable energy investment in 2018 shown in the UNEP report was disappointing, the IEA says the prospects for this year are more encouraging.

The IEA expects renewable energy additions to grow by 12% in 2019, the fastest pace since 2015 to reach almost 200 GW again led by wind and solar PV. But this is still only two-thirds the level of additions the IEA sees as necessary to meet the Paris Agreement targets.

Both UNEP and the IEA attribute the 2018 decline in investment mainly to a policy change affecting the financing of Chinese solar projects. Both highlight the critical role government policy has on renewables deployment.

“The stark difference between this year’s trend and last year’s demonstrates the critical ability of government policies to change the trajectory we are on.” Fatih Birol, Executive Director International Energy Agency (IEA)

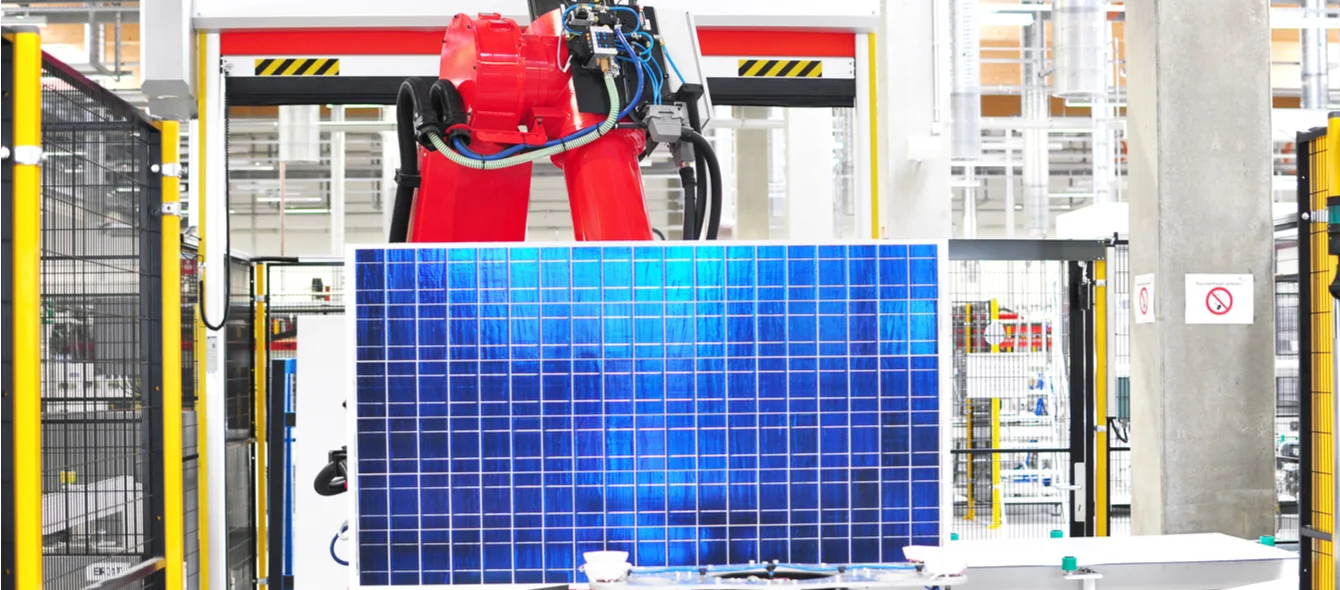

Photo credits: © industryviews, shutterstock.com