According to the Center for Automotive Research (CAR), almost 770,000 electric cars were registered in Europe in the first nine months of 2020. This is a record high, which – for the first time ever – has surpassed the figures in China, home to the largest number of e-vehicles in the world. The European market is growing rapidly with demand for batteries increasing as the electrification of the transport industry picks up speed. Although production is currently still focussed in Asia, Europe is now playing catch-up. Various new factories are set to be built in the coming years in Germany, France, Sweden and also Eastern Europe, to name a few. en:former will be dedicating a two-part series to taking a closer look at the various projects.

By 2029, European battery cell production capacity could increase tenfold – from its current 30 gigawatt hours (GWh) to 300 GWh – according to market research company Benchmark Mineral Intelligence (BMI). The race to become global market leaders has also found political support: the EU are looking to invest hundreds of millions of euros in research, whilst financial support for establishing manufacturing plants is also on the table.

In 2017, Vice-President of the European Commission Maros Šefčovič launched the European Battery Alliance (EBA), which brings together national authorities, organisations and industry stakeholders to strengthen the EU’s battery value chain. The alliance now spans over 440 members and its goal is not unambitious: by 2025, factories in Europe are to meet local demand, rendering imports from Asia and the US superfluous. This would mean building ten to 20 facilities which are similar in size to the Tesla plant in Nevada, USA. The manufacturing plant, which Tesla itself has named the ‘Gigafactory’, has a capacity of 20 GWh. A figure that is only set to keep in growing.

An e-car’s carbon footprint varies depending on where its battery has been produced

With a strong battery sector of its own, the EU would not only become less dependent on foreign suppliers, it would also improve the carbon footprint of its e-cars. Battery manufacturing consumes a considerable amount of energy, so the local power generation mix is key. If it is largely dominated by fossil fuels, such as e.g. in China, then the battery’s carbon footprint, and thus also that of the car manufacturing process, will be more significant. Only the mining of raw materials to be used in the cells emits more greenhouse gasses. Germany, where renewables are gaining ground, most recently emitted around 400 grammes of CO2 per kilowatt hour (kWh) produced. In Europe the average was 520. In China, where coal-fired power is king, the figure exceeded 800 grammes.

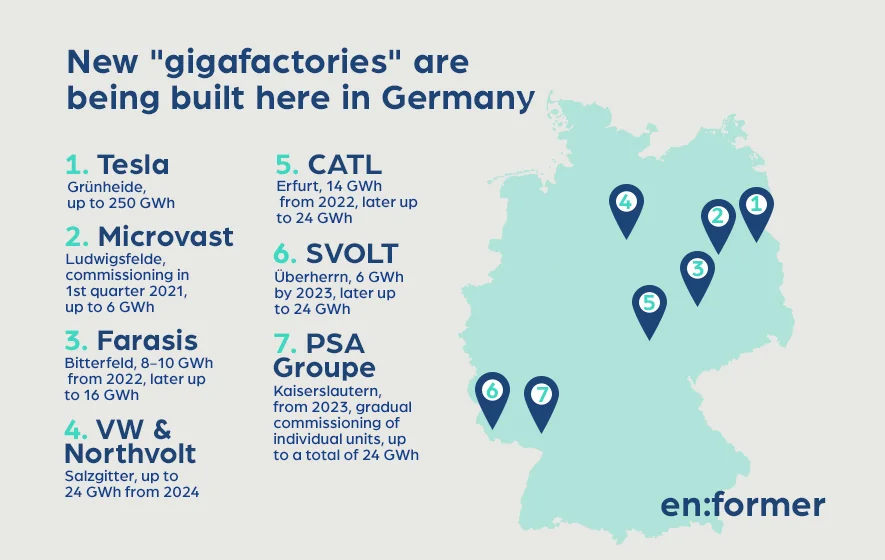

Now Germany is taking centre stage of the European battery boom – not least because US car manufacturer Tesla is looking to build its next ‘gigafactory’ in Grünheide near Berlin. Germany also has its sights set on other large-scale projects. Automotive manufacturers VW and Opel, for example, are looking into having the batteries for their electric vehicles manufactured in Germany. In addition, a number of Asian manufacturers, including CATL, Farasis and SVOLT, see Germany as a prime location for future manufacturing. They all want to expand into Germany, which – according to BMI – is soon to be home to more than half of Europe’s manufacturing capacity.

In the first part of our overview, we will therefore be taking a closer look at some of these ‘gigafactories’ set to be built in Germany in the coming years.

In Grünheide, Brandenburg, construction is already well underway for Tesla’s e-car manufacturing facility. And, according to Tesla’s CEO Elon Musk, the world’s biggest battery factory is to be built right next door. According to the US car manufacturer’s plans, it could boast a capacity of 100, one day possibly even 250 GWh.

The construction of another battery factory, directly adjacent to Tesla, is also already in full swing. Microvast, founded in Texas in 2006, has set up its European headquarters in Ludwigsfelde, not far from Berlin, where it plans to assemble battery modules for the European market from Q1 of 2021. Their Chinese affiliate Microvast Power Systems Co. Ltd. will provide the necessary cells, which are suitable for e-cars, buses and more. At some point in the near future, the company wants to hit a manufacturing capacity of six GWh. Unlike the other manufacturers on this list, Microvast is not intending to produce cells in Germany, but will instead be focussing on building modules.

Chinese battery manufacturer Farasis has found a strong partner for its plans to expand into the German market. None other than Mercedes Benz AG of the Daimler Group has secured a three percent stake in the lithium-ion-battery technology company. The automotive group hopes to harness this partnership to strengthen its e-mobility activities, and Farasis is building a factory in Saxony-Anhalt for this purpose. The plant’s entirely carbon-neutral design sets it apart from the factories of its competitors.

The company already has research centres in the US and Germany, but until now manufacturing has been limited to two plants in China. The first batteries are to be manufactured in Bitterfeld-Wolfen in 2022. Initially with a capacity of eight to ten GWh, Farasis will later have up to 16 GWh. Yet this East German location will not only manufacture batteries for electric cars. In the long term, the site is set to grow to become a centre of excellence, boasting everything from R&D to recycling – all combined under one roof. This could lead to the creation of up to 2000 jobs over time.

Volkswagen is hoping to have built a factory for lithium-ion battery cells, together with Swedish battery manufacturer Northvolt AB, at its Salzgitter plant by 2024. The group plans to invest 450 million euros in the ‘Northvolt 2’ manufacturing facility. According to the carmaker, manufacturing capacity is initially pegged at 16 GWh.

“In addition to securing external suppliers, we are building up additional capacity,” says Dr Stefan Sommer, Volkswagen Group Board Member for Components and Procurement and a member of the Northvolt AB Board of Directors. To this end, Volkswagen and Northvolt established a joint venture back in September 2019 to make way for the series production of lithium-ion batteries in Germany. Constructing the buildings and necessary infrastructure is the next step on the road to a future dominated by e-mobility.

Chinese battery producer and the world’s largest manufacturer of battery cells, Contemporary Amperex Technology (CATL), is heading to Erfurt, Thuringia to build its first factory outside its home market. From 2022, lithium-ion batteries set for the European market are to be manufactured at the 23-hectare site of the insolvent photovoltaics manufacturer Solarworld. Initially with a capacity of 14 GWh, it will later grow to accommodate up to 24 GWh. This will create around 2000 jobs by 2024.

“The automotive industry in Germany holds considerable sway and is also home to several of CATL’s key customers,” says Matthias Zentgraf, Co-President Europe of CATL. The company has already developed partnerships with a slew of well-known companies to sell its energy storage solutions: BMW, Volkswagen, Daimler, Bosch and Volvo have all expressed an interest in the batteries of this Chinese-German collaboration.

SVOLT Energy Technology is another Chinese battery manufacturer expanding into Europe. More precisely, to Überherrn in Saarland. Following a split-off from Chinese automobile group Great Wall Motors, SVOLT is now cooperating with BMW, among others. The market is set to soon include other vehicle manufacturers, German and French in particular, with the construction of a factory on the ‘Linslerfeld’, an area near the French border. SVOLT is aiming to have completed the first construction phase, with a capacity of six GWh, by 2023. There is talk of more capacity to follow, as much as 24 GWh in the final stages, depending on how demand develops over time.

Another car manufacturer has its sights set on producing its e-car batteries in Germany together with Opel. This will lead to the construction of one of the largest gigafactories in the country in Kaiserslautern. Together with Opel’s parent company PSA and battery company Saft, a subsidiary of Total, the German group has formed a joint venture to join battery manufacturing forces in Europe. Another factory, in addition to the one in Rhineland-Palatinate, is planned for Douvrin in northern France. From 2023 onwards, both plants are to go into operation in steps of three blocks and eight GWh capacity apiece. This will bring the total capacity up to 48 GWh. Or in other words – enough to equip 500,000 Opel Corsa-e models with batteries.

The second part of our series is dedicated to exciting projects in other European countries.