Power sockets that provide electricity whenever, wherever and a domestic connection to the local gas supply system are two everyday amenities that most of Europe’s population take for granted. But before this energy is delivered to the end consumer, it goes through an entire market process. The European Union has its own internal energy market, with its own set of rules. en:former will be dedicating a new miniseries to shedding a light on trading and pricing in these markets. Our first stop is the electricity market.

A good starting point to gain a better understanding of today’s market mechanisms is to take a trip down memory lane: in the 1990s, the energy markets had a strong national focus and featured fewer players than today. They followed quite rigid processes to determine electricity demand and set prices. Shortly before the turn of the millennium, EU member states decided to progressively liberalise this system.

The basic rules

A whole spate of regulations and ordinances have been passed since then. Important updates have included separating power generation, transmission and sales; expanding the common European market; and introducing market-led principles such as supply-and-demand-based pricing.

This created true competition, enabling consumers to choose from a variety of providers. While ‘the European Green Deal’ is also set to lead to the introduction of a range of incentives for driving the expansion of renewables. In May 2024, the EU introduced a new electricity market reform.

The players

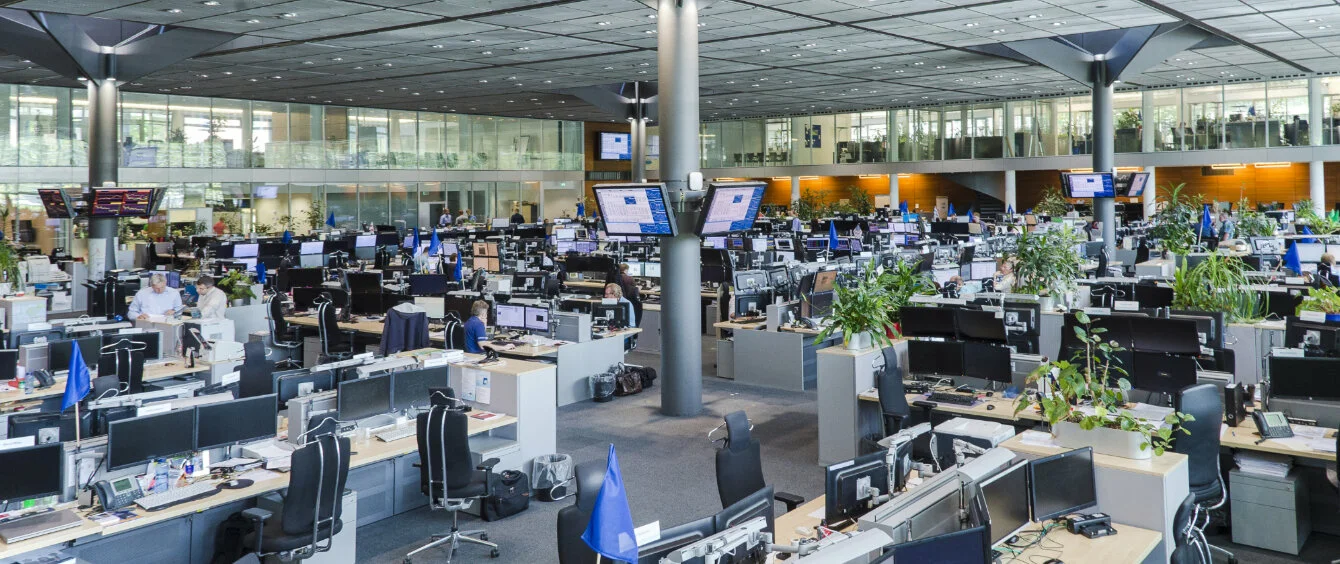

Today, there are myriad players active in this market. They all play their part to ensure security of supply at any given location and at any given time:

Power producers are, generally speaking, power plant or renewable facility operators. They can choose to either sell the electricity they generate ‘over the counter’ (or OTC trading for short), this means to sell it directly to large customers such as industrial enterprises or energy suppliers. To do this, they often come together as business partners through brokerage firms. Various companies have established themselves as specialists in this field, concluding contracts between producers and customers. This type of trading usually takes place on online platforms. In addition to OTC trades, there are also electricity exchanges such as the EEX in Leipzig.

Although it is referred to as ‘direct marketing’, only a small number of power plant operators sell electricity on the exchange themselves. They tend to entrust this task to a ‘direct marketer’, who sells the electricity for the power producer in return for a commission.

Transmission systems are used to transport large volumes of electricity nationwide via high-voltage power lines operated at voltages of up to 440 kilovolts. They supply the medium and low-voltage systems run by distribution system operators and major customers such as chemical parks and aluminium plants with power.

Ensuring end consumers are supplied with electricity is the job of the utility companies. Oftentimes, they are public utilities that also operate regional medium and low-voltage networks, which they use to supply end consumers with electricity. Since the liberalisation of the markets, however, a utility company no longer needs to also be a distribution system operator.

This new hierarchy means that end consumers are taking on an ever more important role: because private customers choose their own electricity provider, the have an indirect impact on pricing. Since the latest reform, they can also choose between contracts with fixed or variable prices that are based on the market.

Pricing

Depending on the model used by a national market, pricing may vary at each individual distribution level, as each member state sets their own taxes, duties and surcharges. In Germany, for example, taxes, duties and surcharges (in particular the EEG surcharge) accounted for 51 percent of household bills, while grid charges added another 25 percent. Producers and utilities can only influence a small proportion of the price by reducing production costs or administrative expenses or by purchasing on the exchange at favourable conditions.

Although the EU has one common internal energy market, each of the national markets in the various member states follows their own rules and there are two fundamentally different systems. The ‘energy-only market’ (EOM), which was introduced in Germany in the late-1990s, for example, and the ‘capacity market’, which has been the status quo in France since 2017, for example. Great Britain, now no longer a member of the EU, has used the latter system even longer.

An energy-only market only compensates power that is actually produced, at least in short-term OTC and exchange trades. If demand exceeds supply, the price goes up. The system therefore favours electricity generation technologies with low marginal costs, such as solar energy or wind power. If they produce less electricity than is needed to meet demand, additional energy sources are activated. In a market such as this, peak-load power stations, which are predominantly fired with fossil fuels such as coal and gas, are the last to go online in case of supply shortages. They then match the high demand for electricity with very high prices. Designating plants that constantly supply cheap power to generate electricity first follows a sequence known as the ‘merit order.’

Capacity markets, on the other hand, are used to trade production guarantees (France) or available capacities (Great Britain). Wholesalers buy certificates which entitle them to a fixed amount of electricity from the producer at a certain point in time – regardless of whether the buyer ends up taking it or not.

The system promises greater security of supply and gives large power plant operators the necessary planning security, as they are also paid when plants aren’t operating. However, this approach can lead to overcapacities. On the EOM, by contrast, the price itself acts as an indicator of whether additional capacities need to be built. That being said, if there is unease amongst electricity producers, these investments may possibly never be made. This is particularly relevant in relation to Germany’s simultaneous nuclear and coal phase-out.

Forward and spot market

A large portion of electricity is sold before it has been generated. Supply contracts on the forward market are concluded for the months, quarters and years ahead. Electricity suppliers, large consumers and power plant operators hope this will make it easier to forecast energy costs and revenues. Due to the incredibly dynamic pricing, virtually every kilowatt hour of electricity is traded back and forth several times before it reaches the consumer. These transactions are largely OTC trades and do not contradict the EOM model.

Spot markets, on the other hand, are dedicated to trading enough electricity to cover 15 minutes or an hour at a time for the following day. This ensures security of supply is optimised at short notice based on load and generation forecasts. These trades are largely carried out on energy exchanges and are subject to much smaller leeway in terms of price. This is because all parameters – such as approximate demand, CO2 price and feed-in from renewables – are already known. What’s more, they only involve players that physically fulfil contracts – in other words, no banks or speculators. Thus, there are times when it may even be lucrative for producers to buy back the energy they had previously sold forward, to then sell it at even better margins on the spot market.

To be able to react to extremely short-term fluctuations – for example if wind and solar farms produce less electricity than expected or a power station suddenly fails – there is also the intraday market. These energy exchanges are geared towards trades that give sellers five minutes’ notice to deliver the necessary power.

As part of the electricity market reform in 2024, the EU has adopted rules to protect consumers from very high electricity prices in the event of an energy crisis. For example, the member states are to reduce prices for people who are particularly affected by the crisis. In addition, stricter regulations will apply in future to ensure a level playing field. To this end, the European Union Agency for the Cooperation of Energy Regulators (ACER) will be given more extensive powers.

Finally, the operating reserve market gives additional peace of mind when it comes to ensuring security of supply. These markets are dedicated to energy reserves that are auctioned off by TSOs when needed and called up within seconds. We will be delving deeper into this topic over the next instalments in our series.

Note from the editors: This article was updated in July 2024.