To date, with its electricity sector dominated by nuclear power, France has been relatively slow to get into offshore wind, but that all looks set to change. On March 24, the European Investment Bank (EIB) granted a €350 million credit line to the consortium developing the 450 MW Courseulles-sur-Mer wind project 10-16 kilometres off Calvados, Normandy. In June last year, the EIB swung its support behind the 497 MW Fécamp wind farm, providing a €450m credit line to the project, which will also be located off the Normandy coast.

Firm orders were placed for turbines last year for both Fécamp and the 496 MW Bay of Saint Brieuc project, which is under construction 16.5 kilometres off the coast of Brittany and expected to come into operation in 2023. The main components of the turbines for both wind farms will be manufactured in a new facility being built at Le Havre by Siemens Gamesa.

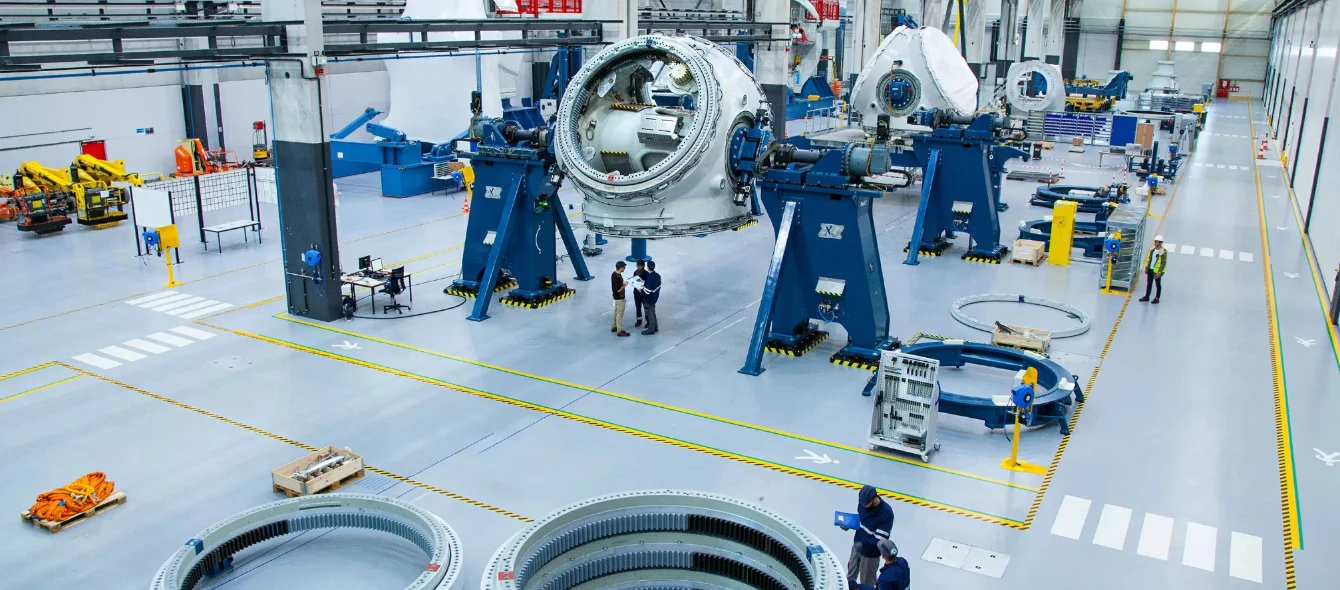

Construction of the Fécamp wind farm

Starting gun delayed

France held its first round of tenders for offshore wind back in 2012, but developers have had to jump a series of administrative and legal hurdles to get projects off the ground. The 480 MW Saint Nazaire offshore wind project, awarded in 2012, only started construction last year. Both Fécamp and Saint Brieuc were awarded in 2012, along with Courseulles-sur-Mer. The combined capacity of the 2012 awards was 2 GW. In 2014, a second round saw tenders awarded for two further projects, the 496 MW Dieppe-Le Tréport and the 496 MW Ile d’Yeu et de Noirmoutier wind farms.

However, what really grabbed attention was the tender for nearly 600 MW capacity off Dunkerque in June 2019, which was awarded at a price of just $50/MWh (€44/MWh), less than a third of the renegotiated feed-in tariff set for projects under rounds one and two. At this price level, offshore wind in France had truly arrived.

Government ambitions grow

In April 2020, the government adopted its Multi-Year Energy Programme (PPE), which set a new, higher target for offshore wind of 5.2-6.2 GW in operation by 2028. The target for 2023 is 2.4 GW.

In December 2020, a tender was launched for 1 GW of capacity off the Contentin penisula in Normandy. This is expected to be followed by a tender for 0.5-1.0 GW in Sud-Atlantique, and then three 250 MW tenders for floating offshore wind projects over the course of 2021 and 2022. A 1 GW tender is on the cards for 2023 and the government intends to tender 1 GW of capacity a year through to 2030. France also has four pilot offshore floating wind projects under development, three with 24 MW capacity and a fourth, EolMed, with 25 MW.

Major market emerging

The surge in activity means France could move from a position of having no large-scale wind farms today to as much as 12.4 GW of installed and under-development capacity by 2028. A more conservative forecast by Rystad Energy estimates France will have 7.4 GW of offshore wind in operation in 2030, making it the fourth largest offshore wind market in Europe, behind the UK, Germany and the Netherlands.

France forecast compared to European targets for 2020 in GW

Source: Rystad Energy Offshore Wind Dashboard, IEAEven this would only tap a fraction of France’s overall potential. A study conducted by BVG Associates for industry body WindEurope in June 2017 estimated, based on the development of offshore wind technology to 2030, that northern France had a gross offshore wind resource of around 6,000 TWh/year and technical potential of about 1,200 TWh/yr, more than double France’s 2019 electricity supply.

France’s Mediterranean coastline also offers significant opportunities. A study published in 2019, Large-scale offshore wind production in the Mediterranean Sea, found that of all Mediterranean littoral states, France had the highest annual average wind speeds of 7-8 metres per second. This suggests potential in the Gulf of Lion for-fixed bottom installations, but the Mediterranean seabed then falls away sharply to greater depths, where floating offshore wind technology would be more applicable.

Clean energy strategy unfolds

Offshore wind has become a core part of the government’s energy transition plans. In addition to the reduction of greenhouse gas emissions, additional clean renewable energy is needed for two reasons. First, France has been quick to limit electricity generation from coal. In 2019, coal-fired plant provided just 1.6 TWh of power out of total supply of 537.7 TWh, ahead of coal‘s intended phase out in 2022. Second, the government aims to reduce the share of nuclear power in the generation mix to 50% by 2035. Last year, nuclear power provided 70% of France’s electricity.

Forecasts by electricity system operator RTE suggest power demand will remain relatively flat at least up until 2025, but the gradual ramp down in nuclear generation, as the aging reactor fleet enters a period of sustained maintenance, means renewables and gas-fired generation need to step into the gap.

Photo credit: fokke baarssen, shutterstock.com